Open a new account

Account Login

Thank you for visiting xtrade.com

You are currently viewing our global website which is not directed at EU residents.

Please let us know how you would like to proceed.

How Volatility Contributes to Effective Crypto Trading

What is Digital Currency?

The cryptocurrency boom is alive and well down under. Digital currencies a.k.a. crypto

exists on the blockchain, over the Internet. There are currently well over 11,000+

cryptocurrencies available to traders, investors, speculators, and everyday folks all over

the world. The most popular cryptocurrencies include the likes of Bitcoin (BTC), the gold

standard, Bitcoin Cash (BCH), Cardano (ADA), Ethereum (ETH), Dogecoin (DOGE), Stellar Lumens

(XLM), Ripple (XRP), and Litecoin (LTC).

Despite the fact that some 11,000+ cryptocurrencies exist, the market remains heavily tilted

in favour of the top 10 digital currencies, which together account for the lion’s share of

the total market capitalisation. Consider the following top 10 cryptocurrencies:

- Bitcoin (BTC)

- Ethereum (ETH)

- Cardano (ADA)

- Binance Coin (BNB)

- Tether (USDT)

- Solana (SOL)

- Ripple (XRP)

- Dogecoin (DOGE)

- Polkadot (DOT)

The volatility of cryptocurrencies is notable, and rapid daily price swings are entirely

possible. Despite a heavy concentration of assets in the top 10 cryptocurrencies, the market

is really dominated by the top 5. Combined, these comprise well over 70% of the entire

digital currency market. That means the market capitalisation of the 11,000+

cryptocurrencies only makes up 30% of the total market capitalisation.

It comes as no surprise that Bitcoin (BTC) is the rock star of the digital currency market.

The popularity of Bitcoin has skyrocketed in recent years, and this digital currency remains

the gold standard in the industry. Not only does Bitcoin have incredible brand awareness

among devotees, it's also well-known by people that have little or no interest, or

understanding of the cryptocurrency market.

As far as Ethereum goes, this digital currency was conceptualised by Vitalik Buterin several

years after Bitcoin was launched. ETH is a peer-to-peer, open source blockchain technology

where adoptees can create decentralised applications on the Ethereum blockchain. These are

known as dapps. Over the years, Ethereum (ETH) has become one of the most attractive digital

currencies for adoptees, with daily trading volumes often rivalling that of Bitcoin. It is

worth pointing out that Bitcoin doesn’t always have the greatest trading volume, because

Tether (USDT), a stablecoin, routinely trades at significantly greater volumes.

Cryptocurrencies a.k.a. digital currencies operate outside the realm of established

financial systems. They are decentralised and not subject to the whims of central banks, and

government oversight agencies. Neither do they rely on third-party representatives in the

financial arena, with existing legacy systems. Bitcoin (BTC) was the breakthrough

cryptocurrency, spearheaded by an enigmatic individual, entity, or group of people known as

Satoshi Nakamoto.

The reason for Bitcoin’s creation was published in the Bitcoin White Paper. Among others,

the White Paper stressed the need for a fully decentralised digital currency as an

alternative to fiat currency and legacy systems. Bitcoin allows for rapid, cost-effective,

anonymous transactions processing between senders and receivers. Since it operates on the

blockchain, transactions are immutable and double spending is impossible. Among the many

benefits of owning, trading, and using cryptocurrency are the following:

- Cryptocurrencies do not require legacy systems, financial intermediaries, or middlemen to help process transactions.

- It is possible to code financial derivatives (loans and trading strategies) into the blockchain, thereby removing the need for financial intermediaries.

- The blockchain allows swift asset transfers, with third-party approval at later dates.

- Thanks to the decentralised nature of blockchain technology, only the sender/receiver are involved in transactions processing. This eliminates uncertainty, misinformation, delays, and reduces costs.

What is Crypto Trading All About?

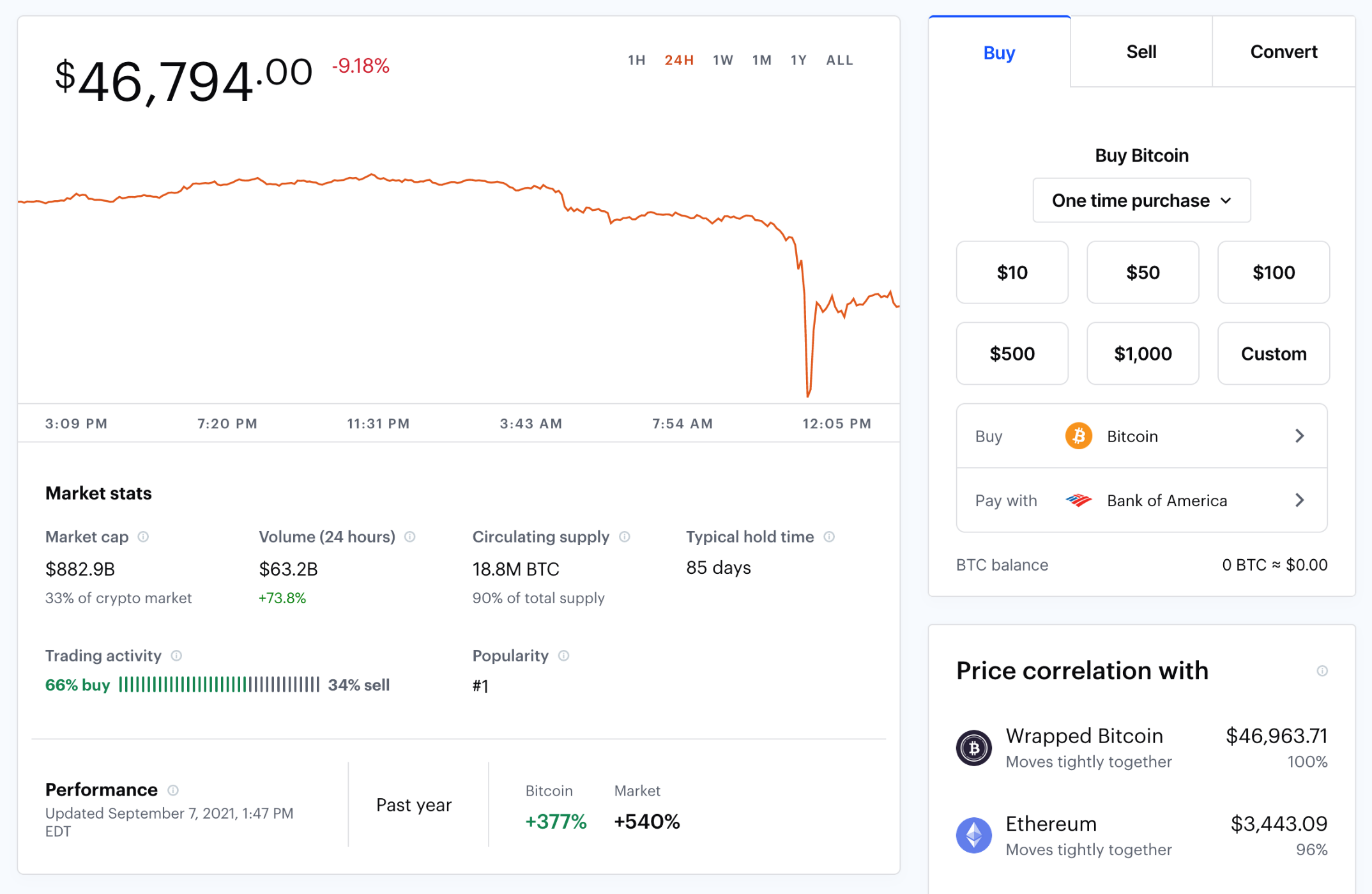

Source: StockCharts BTCUSD September 2021

Cryptocurrency, like foreign exchange, can be traded online. Xtrade Australia is a fully

regulated brokerage which facilitates CFD trading for you. There are several ways to trade

crypto. A popular option is crypto versus crypto, or crypto versus fiat. The latter refers

to fiduciary currency i.e. coins and banknotes, and is issued by the central bank of every

country. Typically, you will see crypto quoted against the top fiat currencies such as the

AUD, GBP EUR, or USD. When quoted this way, you can instantly gauge the value of 1 unit

cryptocurrency and the equivalent AUD, GBP, EUR, or USD amount.

At Xtrade Australia, you can easily trade any underlying financial instrument across

multiple different categories. These include digital currencies, exchange traded funds,

stocks, bonds, indices, forex, and commodities. When you trade one of these assets, you are

buying/selling the assets with the intention of generating a profit. In a traditional sense,

trading requires you to buy low and sell high.

However, with crypto trading it’s possible to trade in rising or falling markets. In other

words, you can short cryptocurrency when your expectations are bearish. Short selling is a

common trading tactic with day traders. The profits generated through short selling are the

difference between the buy price & the sell price. With a short sale, you sell the financial

instrument now and hope to buy it back later at a cheaper price, pocketing the difference.

Caution:

Cryptocurrency markets are inherently volatile and wild price fluctuations can take place at

any given time. It's important to have a risk mitigation strategy in place to guard against

unfavourable price movements. Australian traders can use market orders, limit orders, and

stop loss orders at Xtrade’s powerful trading platforms.

Source: Bitcoin (BTC) Coinbase

Whipsaw price movements are common with cryptocurrency. At any given time, prices can rise

or fall dramatically. Crypto price movements are unlike ETFs, commodities, indices, bonds,

or even forex. There are different types of traders and investors with crypto. Many prefer

to buy and hold, otherwise known as HODL digital currency, hoping for long-term price

appreciation. For an investor, the short-term horizon is irrelevant.

The price wobbles are accepted as part of the inevitable move towards an upward sloping

long-term price chart. That's precisely what has happened with Bitcoin since 2009, Litecoin

since 2011, and Ethereum since 2015. Similar charts are evident with other cryptocurrencies

across the board. Today, several ranking cryptos are worth thousands of dollars apiece, with

virtually unlimited upside potential available. For traders though, it's all about

capitalising off short-term price movements.

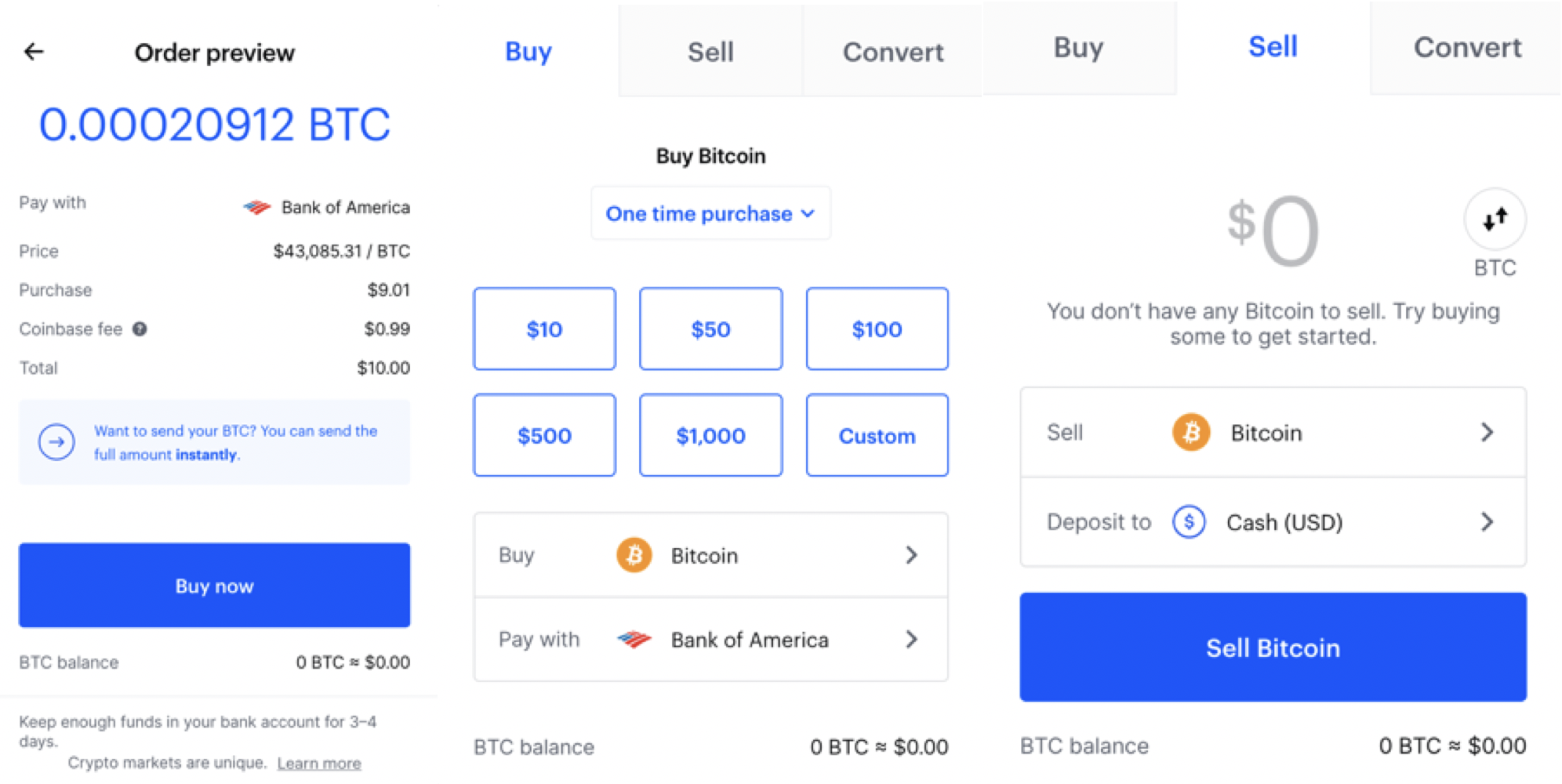

Source: Coinbase Buy & Sell Bitcoin (BTC)

There are several ways to get started with crypto trading in Australia. The first order of

business is determining how you would like to trade digital currencies. The traditional

method of registering at a cryptocurrency exchange and actually buying digital currencies

such as Bitcoin, Ethereum, Litecoin, Cardano, Bitcoin Cash, Dogecoin, Ripple, and the like

is certainly possible. Register an account with a reputable crypto exchange such as Swyftx,

Digital Surge, Independent Reserve, CoinSpot Exchange, Binance Exchange, Easy Crypto

Exchange and others. It is easy to start trading with fiat currency such as Australian

dollars, New Zealand dollars, or US dollars, or in digital currency such as Bitcoin,

Ethereum, Litecoin, etcetera.

For many cryptocurrency enthusiasts, the thought of storing crypto at an exchange is

unappealing. This is largely a result of multiple hacks over the years at top-tier exchanges

such as BitGrail, Coincheck, Mt Gox, and Bithumb. For this reason, traders and investors

tend to prefer external cryptocurrency wallets such as the Ledger Nano for safely storing

the codes for digital currency. There are many other ways to dabble in crypto, such as

indirect crypto trading options with GBTC Trust, Square Cash App, or even Grayscale Trust.

The CME Micro Bitcoin Futures market is yet another option to consider, with full on risk

mitigation potential geared towards capital efficiency of operations.

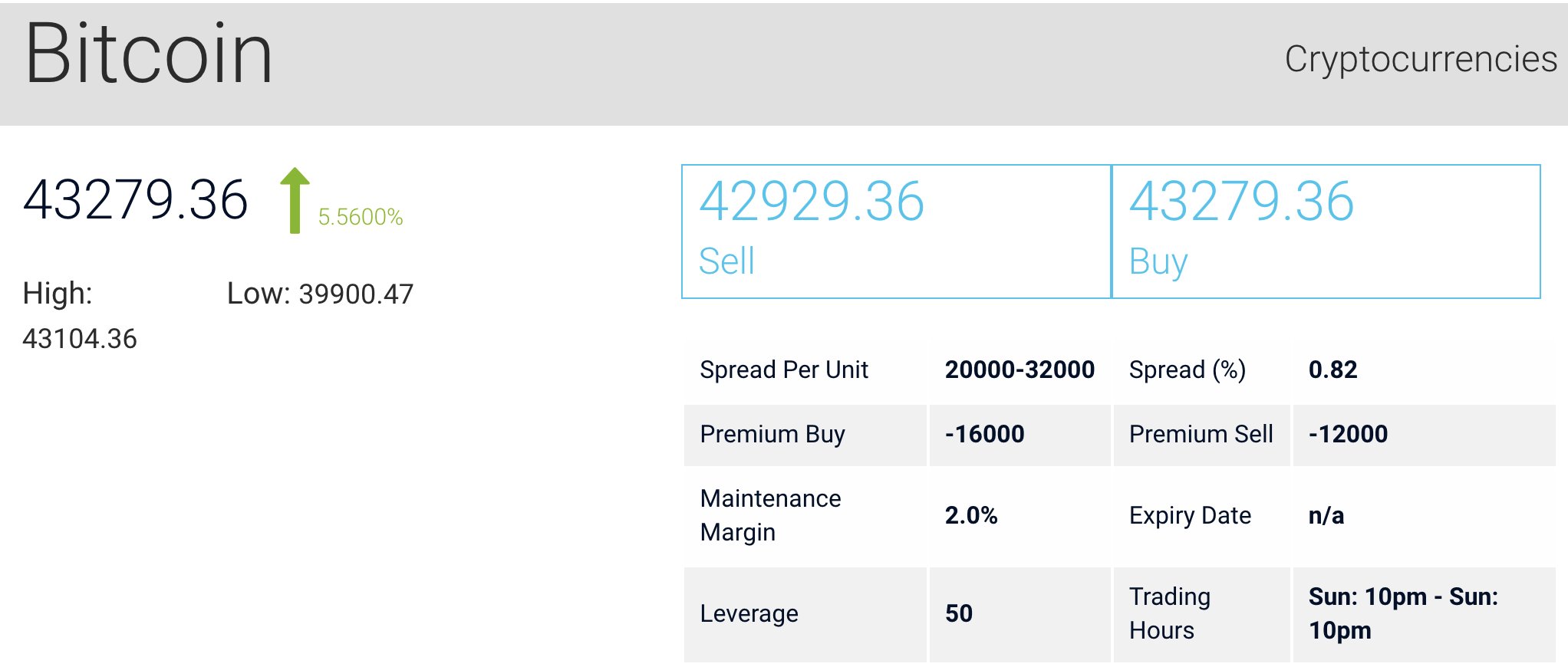

Here at Xtrade Australia, it's all about derivatives trading. As the name suggests, a

derivative is a type of trading instrument which derives the price from the underlying

financial instrument. These derivative trading instruments are known as CFDs. Contracts for

Difference are available for different asset types such as Ethereum CFDs, Bitcoin CFDs,

Litecoin CFDs, et al. With a derivative, you don't ever own the underlying asset. You’re

simply trading price movements of the financial instrument. Another benefit of trading

crypto CFDs is the availability of leverage on trades. You can maximise the trading power of

your capital by a multiple, courtesy of the broker. With a CFD, the trader and the broker

agree to exchange the difference in value between the opening price and the closing price of

the financial instrument.

Source: Xtrade Australia Bitcoin CFDs

At Xtrade Australia, traders can easily buy or sell the cryptocurrency, with speculative

insights about price movements. The price of the Bitcoin CFD mirrors the price of Bitcoin -

the underlying financial instrument. CFDs are not without their fees, charges, or

commissions. Each broker is different. Costs include premium sell, spread percent, and

maintenance margin. It is important to trade cautiously with crypto. These financial

instruments have whimsical price movements, often rising or falling dramatically on nothing

more than sentiment. Careful attention to detail is required when trading crypto CFDs.

Speculative sentiment determines how prices are likely to move.

At Xtrade Australia, the following leverage is applied to our list of CFD financial

instruments:

- 2:1 for CFDs referencing crypto-assets.

- 5:1 for CFDs referencing shares or other assets.

- 10:1 for CFDs referencing a commodity (other than gold) or a minor stock market index.

- 20:1 for CFDs referencing an exchange rate for a minor currency pair, gold or a major stock market index.

- 30:1 for CFDs referencing an exchange rate for a major currency pair.

Risk Disclaimer: CFD trading is inherently risky, and not suitable for all types of traders

Caveat: It is important to understand that traders are liable for the full value of the trade, not simply the margin requirement.

Top Brokers that Offer Cryptocurrency Trading

Your choice of broker is an important consideration. To this end, only licensed and regulated brokers will suffice. Many brokers today operate in unregulated markets, making it highly risky for traders to deposit funds into their accounts. It's always best to safeguard your investment by sticking with credible brokers. Experts recommend using the following brokers for cryptocurrency trading purposes:

- eToro

- XTrade

- Swyftx

- Binance

- CoinSpot

- Digital Surge

This is but a small sampling of a wide range of reputable derivative trading platforms,

Cryptocurrency exchanges, and brokers that may be available to you in Australia. Not all

brokers are cut from the same cloth. Its best to assess the broker's offerings against your

preferences. For traders who prefer to own digital currency (Litecoin, Bitcoin, or

Ethereum), CFD trading is not the way. The better option is a cryptocurrency exchange where

you can actually exchange crypto for crypto, or fiat for crypto and store it in a wallet.

If you are driven by profit potential alone, then CFD trading will serve you well. You don't

have to worry about storing your cryptocurrency since you are trading contracts. No digital

currencies change hands between yourself and the platform, or other traders. Recall that

CFDs are derivative instruments where price movements are mirrored, and traders can buy and

sell at leisure. It is a high-risk proposition and traders can lose their capital with CFDs.

Other CFD options include the likes of futures (inherently risky), with higher potential

rewards.

Nowadays, most brokers offer a limited selection of digital currencies to trade – not all

11,000+ of them – including XRP, LTC, BTC, and ETH.

Online Crypto Trading and Crypto Platforms

There are notable differences between different types of crypto trading platforms. These are

largely related to the features and functions that trading platforms offer. Many Australian

crypto trading platforms provide derivative trading in the form of CFDs. These leveraged

financial instruments present traders with opportunities and challenges. When you speculate

on the future price movement of an underlying financial instrument and you are correct, the

CFD can finish in the money. However, if the trade goes against you, losses can also result.

Trading cryptocurrency CFDs on margin is a high-risk activity, given the volatile nature of

this market.

At cryptocurrency exchanges, Bitcoin, Litecoin, Ethereum, Ripple, Dogecoin and other digital

currencies are traded as assets. You can store these digital currencies at the crypto

exchange, or in a wallet.

This website uses cookies to optimize your online experience. By continuing to access our website, you agree with our Privacy Policy and Cookies Policy . For more info about cookies, please click here.

or