Open a new account

Account Login

A CFD is a popular derivative financial instrument available at Xtrade Australia. CFD stands for

Contract for Difference. The definition of a CFD is easily derived, since CFDs are contracts whereby the

trader and the broker agree to exchange the difference in value between the opening and closing price of

the contract. Right off the bat, it should be noted that CFDs are extremely risky financial instruments

and the majority of traders lose money with CFDs.

CFDs mirror the prices of the assets they represent. In financial jargon, these are known as the

underlying financial instruments. Therefore, a Share CFD representing Google (NASDAQ: GOOG) may be

priced at $2750 (AU$3850), which is usually identical to the actual share price of Google on the NASDAQ.

That's why the word derivative is so important; CFD prices are derived from the assets they represent.

Therefore, if the underlying financial instrument rises in price then the price of the CFD rises

accordingly. If the underlying financial instrument falls in price then the price of the CFD falls

accordingly. All CFDs fall into a category known as speculative trading. You don't actually buy the

asset, neither do you take possession of the asset. You're simply trading a contract that mirrors the

price movements of the asset.

Xtrade Australia offers

CFD trading

across thousands of financial instruments. These encompass CFD Shares, CFD ETFs, CFD Commodities, CFD

Cryptocurrency, CFD Forex, and CFD Bonds. You are welcome to trade your choice of CFDs at your leisure.

Many traders include CFDs in their portfolio of financial instruments, as part of an effective

diversification strategy.

NOTE: With CFD trading, you are always trading the Contract for Difference, and never

trading the actual underlying financial instrument. If the CFD that you are trading is linked to a spot

price, or a futures contract, there may be expiry dates in effect.

As a newcomer to the trading scene, you know that it's possible to generate profits when financial

instruments appreciate in price. You buy low and you sell high. The difference between the buy price and

the sell price (less costs, charges, fees, commissions) is your profit. As an investor, your strategy is

to buy and hold, allowing for long-term price appreciation. But, as a trader, prices don't need to rise

for profits to be generated. When you trade derivative instruments like CFDs, it is possible to profit

in rising and falling markets.

All CFDs are speculative instruments. Traders use technical and fundamental analysis to determine

whether asset prices will rise or fall over the short-term. If you are optimistic (bullish) about the

price of the assets in question, you BUY the CFD. If on the other hand, you are pessimistic (bearish)

about the short-term price movement of the asset, you SELL the CFD.

Risk Disclaimer: CFD trading is inherently risky, and not suitable for all types of

traders

Caveat: It is important to understand that traders are liable for the full value of the

trade, not simply the margin requirement.

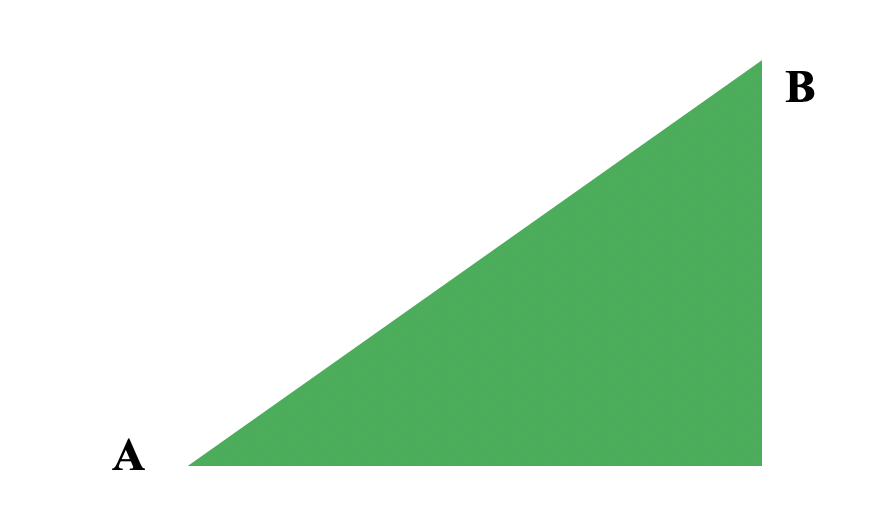

Let's take a look at a few examples of how CFDs work. We begin our analysis with a standard example of buy low sell high.

In the example above, a CFD trader buys at point A, and sell at point B. The price movement from A to B

multiplied by the contract size represents the gross profit. Once you subtract the trading fees,

commissions, charges, or interest on the CFD, you're left with the net profit. CFDs have terms, but

technically they never expire. It becomes very expensive to hold on to a CFD over the long-term, given

the rollover fees, charges, spread, commissions et cetera. These are invariably traded as short-term

financial instruments. Remember, it can certainly happen that the sell price is lower than the buy

price, resulting in a loss of capital.

* CFDs are inherently risky and losses can result. Most traders lose money with CFD

trading.

If the sell price of a CFD is less than the buy price, and you decide to go LONG on the CFD, you will

finish in the red. The figure below indicates losses from a CFD trade when the sell price is less than

the buy price, and you decide to buy the CFD.

Traders can also short-sell CFDs. This is possible with CFD Commodities, CFD Indices, CFD Forex, CFD ETFs, CFD Bonds, and CFD Cryptocurrency too. In fact, any financial instrument available in derivatives format can be shorted. Xtrade Australia facilitates short-selling of multiple assets. Provided the future price is less than the immediate price at which the CFD is sold, you will finish in the black. In this scenario, the difference between the price at which you buy back the CFD in the future, and the price at which you sell it in the present is the profit.

The diagram above indicates how a short-seller generates a profit by selling the CFD at point A, and buying it back later at a lower price at point B. Once trading fees and costs have been deducted, the rest is profit for the trader. Take note that these examples represent favourable outcomes for traders, but losses are entirely possible when you trade CFDs. This scenario is represented in the example shown below where the price of the CFD actually rises in the short-term and the trader had bearish expectations.

As you can see, the trader borrowed a specific amount of CFDs from the broker and sold them immediately at point A. At a later stage, the price of the CFD rose unexpectedly to B. When the trader bought back the CFD, the difference between the prices represents the loss incurred by the trader.

We are proud to offer you thousands of financial instruments in a CFD format. Our list of available CFD

options includes:

Take note that within each category of CFDs (bonds, commodities, shares, ETFs, indices, forex) are

scores of assets available for trading purposes. At Xtrade Australia, registered traders are privy to

competitive spreads and no commissions. We keep costs low by not charging deposit/withdrawal fees.

However, if your CFDs are rolled over (kept open after 10 PM GMT) premiums will be charged to your

account.

list of premium sell and buy charges for each of the CFD products we

offer

All traders are on a budget. Some of us have a big budget, while others have a small budget. Luckily,

you don't have to invest all of your capital in a concentrated selection of financial instruments.

That's because leverage magnifies the trading power of your capital. With leverage, every Australian

dollar has enhanced trading potential. With CFD products, different categories have different amounts of

leverage.

Consider the following leverage on different financial instruments for Xtrade Australia:

Aussie traders are encouraged to conduct the necessary research into the leverage requirements of

different financial instruments. That will tell you how to budget for your trades and diversify your

portfolio. Since different instruments have different capital requirements, it’s always a good idea to

put a trading plan into practice with Xtrade Australia. With the multiplier effect of leverage, you can

increase your profits, or magnify your losses. Use leverage judiciously when trading CFDs. Contrary to

opinion, it is not simply the margin amounts that you are liable for when trades move against you; it's

the full value of the trade.

Sometimes, brokers may initiate what is known as a margin call. This means that additional capital will

have to be withdrawn to keep a CFD position. If there is insufficient capital in your account, the CFD

position may be closed out. Any losses that result will be yours to bear. Margin is closely linked to

leverage.

Margin is simply the leverage ratio expressed as a

percentage.

If leverage of up to 5:1 is available, that means you have a 20% margin requirement. If the leverage is

10:1, that means you have a 10% margin requirement, and if leverage is 30:1, then your margin

requirement is approximately 3.3%. The higher the leverage, the lower the margin. This has its pros and

cons, since magnified profits and losses can result.

Pros

Cons

CFDs are better suited to short-term trading, since there are many fees to consider when rolling over

CFDs from day-to-day. Experts recommend holding a CFD for 1 – 7 days, and while they don't expire, the

costs quickly spiral out of control. With CFDs, any open positions in your account will be subject to

daily rollover fees a.k.a. premiums, which can negatively affect your profitability. The holding rates

and your specific trades will determine the fees you are subject too.

All brokers generate their profits from the spread. This is the difference between the buy price and the

sell price of a CFD. Brokers also charge other fees to their clients, notably finance charges, hedging

charges, interest rates, and the like. If a trade moves against you, the margin amount can be forfeited

to the broker.

CFD trading is risky. Speculation is involved with these short-term financial instruments. Despite the

risks, there are ways to enhance your knowledge and understanding of the financial markets. At Xtrade

Australia, we provide you with a full suite of educational tools and resources. These include charts and

graphs, access to financial analysis, and economic news, to make more informed trading decisions.

It's important to lay out your plans when trading CFDs. Budget allotments must be made for specific

financial instruments. That way, you can avoid the pitfalls of asset concentration. CFDs allow for

diversification by spreading your capital across multiple asset categories. The more detailed your

understanding of the financial markets, the less you have to rely on emotionally-based trading

decisions. Research, selection and timing are key to better trading outcomes. While nothing is

guaranteed in the financial markets, informed traders tend to generate more favourable results.

Learn to use the

trading platforms

available at Xtrade. Our premier platform is WebTrader which offers powerful resources for trading CFDs.

WebTrader runs directly off your browser, no download needed. Enjoy access to real-time market prices

with thousands of financial instruments. While you are learning the ropes, use demo trading accounts to

practice your trades. That way, there is zero risk of loss and maximum experience gain. These top tips

for trading CFDs will serve you well, now and in the future.

Get started with your Xtrade account today

This website uses cookies to optimize your online experience. By continuing to access our website, you agree with our Privacy Policy and Cookies Policy . For more info about cookies, please click here.

or